Bcg Growth Matrix Free Excel Template

And the second tab is suitable when you don’t have the exact market share or market growth. The first tab is suitable when you have relatively precise information on market shares and market growth rates and want to input these numbers. There are two tabs in the free Excel template to make the BCG matrix. Two Variations of the BCG Matrix.

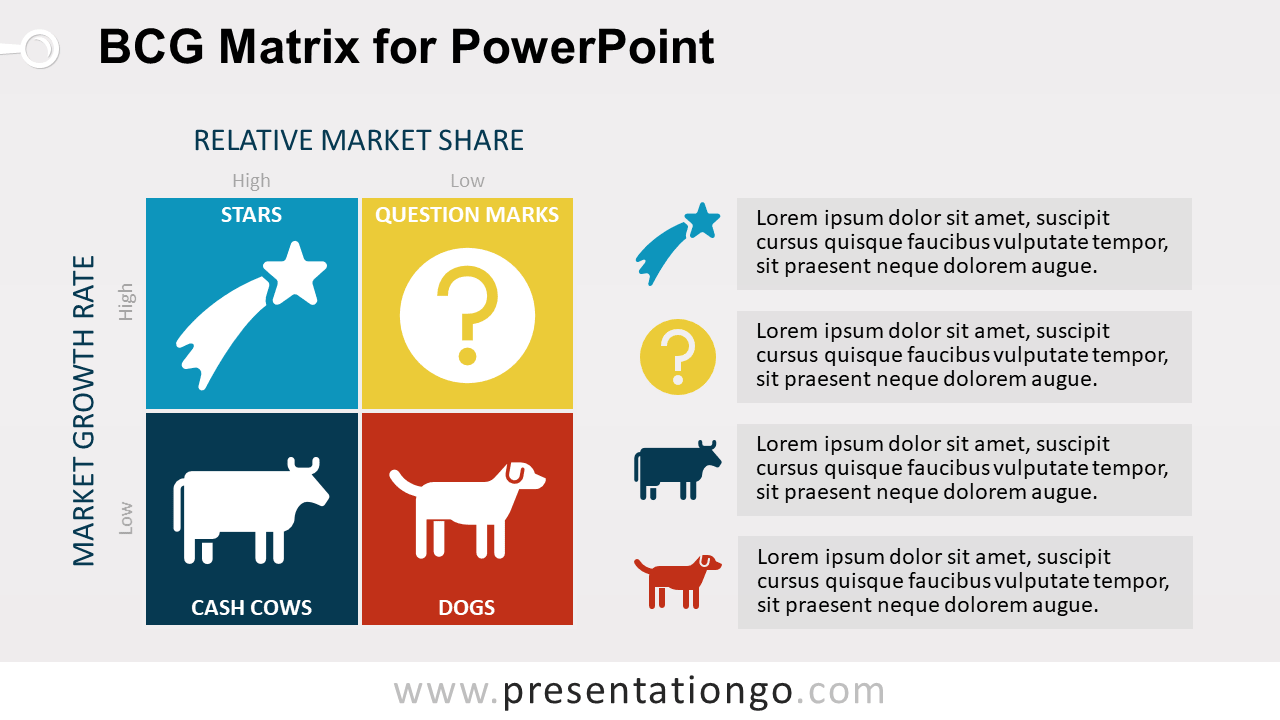

The other of these dimensions is the relative market share of the strategic business unit. These first of these dimensions is the industry or market growth. The matrix consists of 4 classifications that are based on two dimensions. At BCG will connect you with endless opportunities to learn and grow as you.The BCG matrix is a strategic management tool that was created by the Boston Consulting Group, which helps in analysing the position of a strategic business unit and the potential it has to offer.

The advantages of the BCG growth share matrix are manifold.Strategic business units with high market growth rate and high relative market share are called stars. The BCG Growth Share Matrix was evolved in the early 1970s by Bruce Henderson, founder of the Boston Consulting Group, to help corporations make investment and disinvestment decisions related to their business units or product portfolios. The BCG matrix for Pfizer Inc will help decide on the strategies that can be implemented for its strategic business units.BCG Growth-Share Matrix.

Strategic business units with low market growth rate but with high relative market share are called cash cows. These strategic business units require close considerations whether the business should continue with them or divest. Strategic business units with high market growth rate and low relative market share are called question marks.

This will help Pfizer Inc by attracting more customers and increases its sales.The Number 2 brand Strategic business unit is a star in the BCG matrix of Pfizer Inc as Pfizer Inc has a 20% market share in this category. Pfizer Inc should undergo a product development strategy for this SBU, where it develops innovative features on this product through research and development. The potential within this market is also high as consumers are demanding this and similar types of products. This will help it in earning more profits as this Strategic business unit has potential.The Number 1 brand Strategic business unit is a star in the BCG matrix of Pfizer Inc, and this is also the product that generates the greatest sales amongst its product portfolio. Pfizer Inc should vertically integrate by acquiring other firms in the supply chain.

This will help increase the sales of Pfizer Inc.The supplier management service strategic business unit is a cash cow in the BCG matrix of Pfizer Inc. This could be done by improving its distributions that will help in reaching out to untapped areas. Pfizer Inc should use its current products to penetrate the market. The overall category is expected to grow at 5% in the next 5 years, which shows that the market growth rate is expected to remain high.

The overall category has been declining slowly in the past few years. Pfizer Inc is also the market leader in this category. This is an innovative product that has a market share of 25% in its category. The recommended strategy for Pfizer Inc is to stop further investment in this business and keep operating this strategic business unit as long as its profitable.The Number 3 brand strategic business unit is a cash cow in the BCG matrix of Pfizer Inc. The market share for Pfizer Inc is high, but the overall market is declining as companies manage their supplier themselves rather than outsourcing it.

The recommended strategy for Pfizer Inc is to invest enough to keep this strategic business unit under operations. This change in trends has led to a decline in the growth rate of the market. This business unit has a high market share of 30% within its category, but people are now inclined less towards international food. The overall benefit would be an increase in sales of Pfizer Inc.The international food strategic business unit is a cash cow in the BCG matrix for Pfizer Inc. This will help the category grow and will turn this cash cow into a star. It should, therefore, invest in research and development so that the brand could be innovated.

The recommended strategy for Pfizer Inc is to invest in research and development to come up with innovative features. However, Pfizer Inc has a low market share in this segment. Therefore, this market is showing a high market growth rate. The recent trends within the market show that consumers are focusing more towards local foods.

The recommended strategy for Pfizer Inc is to divest and prevent any future losses from occurring.The confectionery strategic business unit is a question mark in the BCG matrix for Pfizer Inc. It has also failed in the attempts made at innovation by research and development teams. However, this strategic business unit has been incurring losses in the past few years. This strategic business unit is a part of a market that is rapidly growing.

The recommended strategy for Pfizer Inc is to undergo market penetration, where it pushes to make its product present on more outlets. The low sales are as a result of low reach and poor distribution of Pfizer Inc in this segment. However, Pfizer Inc has a low market share in this attractive market.

The company also has negative profits for this strategic business unit. This is operating in a market segment that is declining in the past 5 years. The recommended strategy for Pfizer Inc is to divest this strategic business unit and minimise its losses.The Number 5 brand strategic business unit is a dog in the BCG matrix for Pfizer Inc. It also operates in a market that is declining due to greater environmental concerns. This strategic business unit has been in the loss for the last 5 years.

The market share for it is also less than 5%. The market for such products has been declining, and as a result of this decline, Pfizer Inc has been facing a loss in the past 3 years. This will ensure profits for Pfizer Inc if the market starts growing again in the future.The synthetic fibre products strategic business unit is a dog in the BCG matrix of Pfizer Inc. The recommended strategy for Pfizer Inc is to invest in the business enough to convert into a cash cow.

The recommended strategy for Pfizer Inc is to call back this product.Some of the strategic business units identified in the BCG matrix for Pfizer Inc have the potential of changing from their current classification. The market is shrinking, and Pfizer Inc has no significant market share. However, with increasing health consciousness, people are now refraining from consumption of artificial flavours. These products were launched recently, with the prediction that this segment would grow.

A good competitive advantage occurs if it is valuable, rare, and non-imitable. A sustained competitive advantage exists when a resource is valuable, rare, non-imitable and organised. The VRIO analysis requires looking at a firm's resources based on these 4 factors.Based on the analysis, each resource can either provide a sustained competitive advantage, has a good competitive advantage, temporary competitive advantage, competitive parity or competitive disadvantage. The analysis is based on the idea that a firm’s internal resources are a source of sustained competitive advantage if they are valuable, rare, cannot be imitated by competition, and are organised to capture value for the organisation. It helps identify which one of its internal strengths and resources can be a source of sustained competitive advantage. These have been identified in the BCG matrix of Pfizer Inc and recommended strategies to ensure such change have also been made.The VRIO Framework or VRIO analysis is a strategic management tool that is used to analyse a firm’s internal strengths and resources.

The analysis takes place in this order by first assessing whether a resource is valuable, rare, imitable and organised.Barney, J. Lastly, the resource is a competitive disadvantage if it is neither of the 4. A competitive parity occurs if it is only valuable.

0 kommentar(er)

0 kommentar(er)